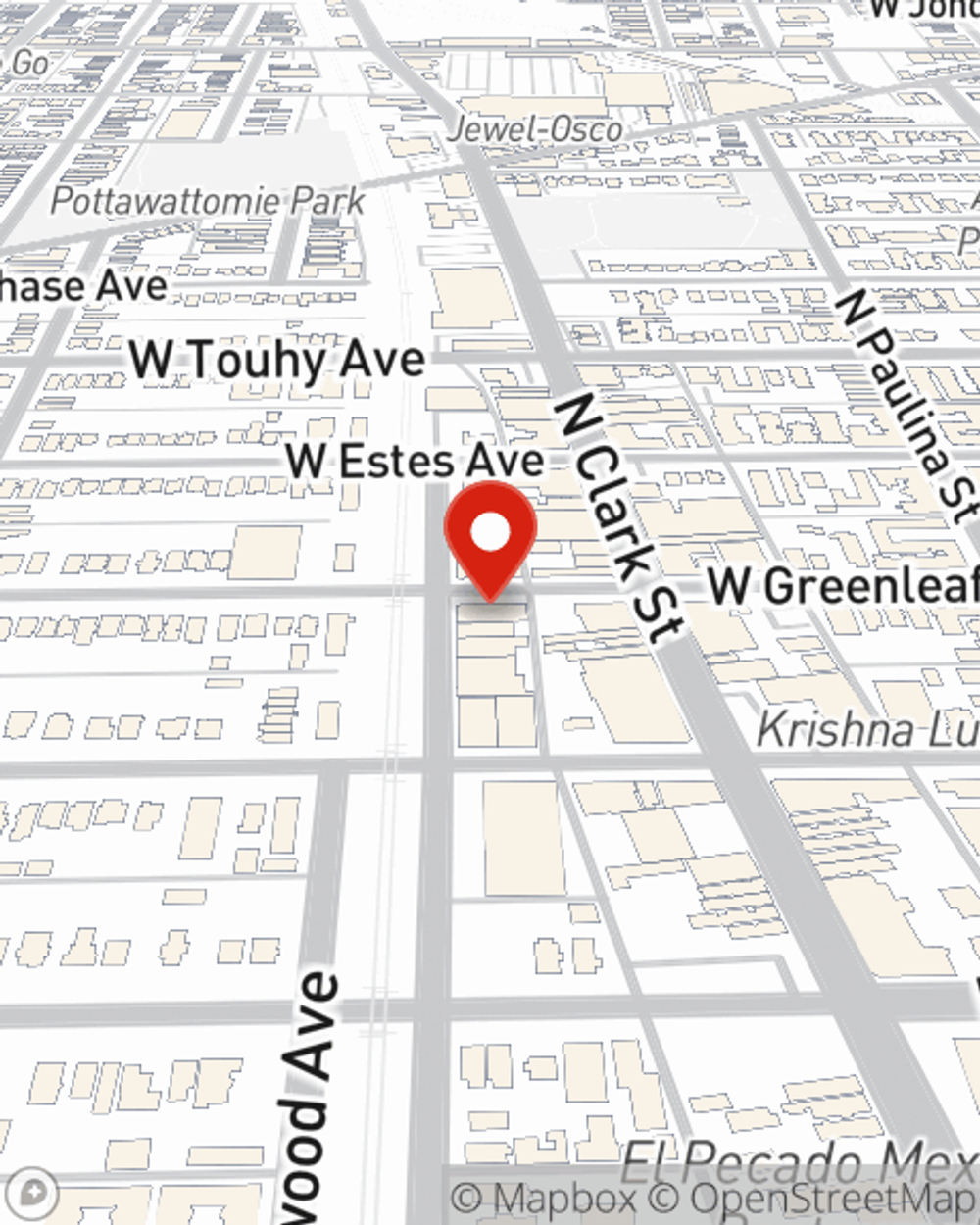

Renters Insurance in and around Chicago

Your renters insurance search is over, Chicago

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Rogers Park

- Indiana

- Wisconsin

- Chicago

- Andersonville

- Edgewater

- Skokie

- Evanston

Protecting What You Own In Your Rental Home

Your personal items and belongings have both sentimental and monetary value. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your smartphone to your hiking shoes. Wondering how much coverage you need? Not to worry! Nick Kosiek stands ready to help you consider your liabilities and help secure your belongings today.

Your renters insurance search is over, Chicago

Renting a home? Insure what you own.

Why Renters In Chicago Choose State Farm

Renting is the smart choice for lots of people in Chicago. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover repairs for smoke damage to the walls or water damage to walls and floors, who will repair or replace your belongings? Finding the right coverage helps your Chicago rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and reliable customer service, Agent Nick Kosiek can walk you through every step to help you helps you identify coverage that safeguards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Chicago renters, are you ready to discuss your coverage options? Contact State Farm Agent Nick Kosiek today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Nick at (773) 754-0446 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Nick Kosiek

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.